As the population's spending power rises, demand for milk and other value-added

milk products is only likely to grow in the coming years. There has to be a

marked change from the unorganized to the organized sector to satisfy the

rising demand. In addition, consumers today not only have greater purchasing

power, but are also conscious of what they consume in terms of health. There is

also a need to provide safe dairy products that can be readily consumed. This

creates an opportunity for boutique dairy farms to set up local operations

providing fresh cow, buffalo or goats milk to consumers. Over and above with

people having less time these days, the demand for premium value-added products

such as probiotic yoghurt, cheese, health shakes etc. are on the rise. Not only

can these goods offer a larger margin, but they also have a higher shelf life,

making the supply chain easier but more cost-efficient.

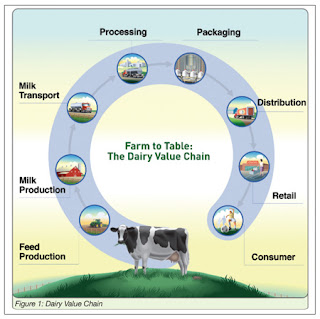

In India, there are different levels of metrics involved in this supply chain process. The first step is to identify the supply of dairy inputs in the form of grain, animal feed plants, animal veterinary aids (cattle and buffalo), dairy farms (large, medium and small-scale farms), milk collection centers (different milk cooperative societies) for the supply of dairy inputs. Milk collected by cooperative societies is sent to dairy plants where milk is frozen, milk and milk products are processed and packed, milk and milk products are transported from one location to another by refrigerated vans or private, government and cooperative vans of insulated milk tankers. Final processed milk and milk products are shipped to various retail stores, pharmacies and retail markets from which processed milk and milk products ultimately reach their end consumers, such as Nuanced payment rationale to suppliers based on fat, solid non-fat (SNF) and the consistency of milk obtained and monitored by truck and tanker routes, as well as capability.

Manual and time-consuming

processes for measuring milk standardization, handling production planning

based on non-standard raw materials, addressing increasing consumer food issues

are some of the problems and challenges that arise during the production and

standardization period. Fat accounting and effective fat loss tracking in the

course of production, etc. And there are still many concerns and issues facing

this sector of the milk supply chain. Issues may emerge from the level of

operation of the retailer, the level of collection site, the level of storage

and logistic stage, co-operative level & marketing levels.

There are risks / challenges for

the future survival of the extraordinarily aggressive Indian dairy industry in

the global dairy market. Extension is critical for the future growth of the

dairy sector. The growth of the Indian dairy industry is attributed to

ancillary improvements made with the arrival of dairy cooperatives.

The milk industry in India is forecasted

to hit INR 16,368 billion in 2022, with a Compound Annual Growth Rate (CAGR) of

16 percent. In India, usage is mostly skewed towards customary goods.

Interestingly, the largest share of the aggregate milk produced in the nation

is buffalo milk. Because as opposed to cow's milk, net sales are high. Although

it is one of the world's largest milk production countries, India accounts for

a marginal share of the world 's milk trade. In global economies, several

restrictions limit competition. In the near future, the ever-increasing

increase in domestic demand for milk products and a broad demand-supply gap

could lead India to become a net importer of milk products.

No comments:

Post a Comment